Do I Need an LLC to Start Dropshipping?

Dropshipping has emerged as a popular business model for aspiring entrepreneurs looking to start an e-commerce venture with minimal upfront investment. However, amidst the excitement of launching a dropshipping business, it’s crucial to understand the legal implications and considerations, including whether forming a Limited Liability Company (LLC) is necessary. In this comprehensive guide, we will delve into the intricacies of dropshipping, the importance of legal structure in business, the role of an LLC, and alternative options available to entrepreneurs.

Understanding the Basics of Dropshipping

Dropshipping is a retail fulfillment method where the seller doesn’t keep the products it sells in stock. Instead, when a product is sold, the seller purchases the item from a third party and has it shipped directly to the customer. This eliminates the need for inventory storage and large upfront investments, making it an attractive option for individuals launching an online store.

Dropshipping allows entrepreneurs to focus on the marketing and sales aspects of their business without the complexities of traditional retail logistics. It’s an enticing prospect for many due to its low barrier to entry and the potential for high-profit margins.

The Appeal of Dropshipping for Entrepreneurs

The appeal of dropshipping lies in its flexibility and accessibility. Entrepreneurs can launch an e-commerce store without the need to invest in substantial inventory or manage product fulfillment. Moreover, the ability to test multiple products and niches without financial risk makes dropshipping an attractive option for those venturing into the world of online business.

The Importance of Legal Structure in Business

Before diving into the specifics of LLCs and dropshipping, it’s essential to recognize the significance of establishing a legal structure for your business. Regardless of the business model, having a formal legal entity provides protection, credibility, and clear guidelines for operations.

Why Legal Structure Matters

Establishing a legal structure for your business is crucial for several reasons. It helps separate personal and business liabilities, provides tax benefits, enhances credibility with suppliers and customers, and lays a solid foundation for future growth and expansion.

Having a legal structure in place also ensures that the business complies with the relevant laws and regulations, mitigating potential risks and liabilities.

What is an LLC?

A Limited Liability Company (LLC) is a popular business structure that provides the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership. LLCs are relatively easy to form and maintain, making them an appealing option for small business owners and entrepreneurs.

Key Characteristics of an LLC

An LLC offers the following key features:- Limited Liability Protection: Members’ personal assets are generally protected from business liabilities.- Pass-Through Taxation: Profits and losses are passed through the business to the individual members, who report them on their personal tax returns.- Operational Flexibility: LLCs have fewer formalities and requirements compared to corporations, providing more flexibility in management and decision-making.

Exploring the Benefits of Forming an LLC for Dropshipping

When considering whether to form an LLC for a dropshipping business, it’s essential to evaluate the benefits it offers. While the decision ultimately depends on individual circumstances and long-term business goals, there are several advantages to forming an LLC for a dropshipping venture.

Asset Protection

One of the primary reasons entrepreneurs opt for an LLC is the limited liability protection it affords. In the context of dropshipping, this means that the personal assets of the business owner are shielded from any potential business liabilities, such as product defects or shipping issues. This separation of personal and business assets can provide peace of mind and financial security.

Credibility and Professionalism

Operating as an LLC can enhance the credibility and professionalism of a dropshipping business. Many suppliers, partners, and customers perceive LLCs as more reputable and trustworthy entities, which can positively impact relationships and collaborations within the e-commerce ecosystem.

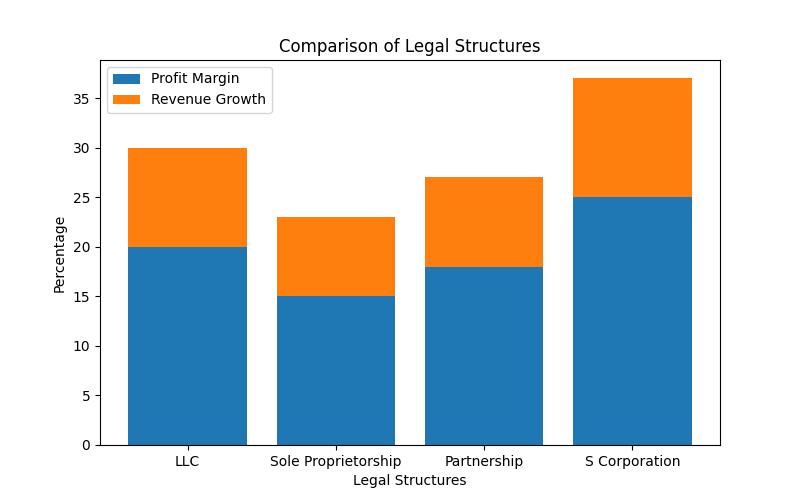

Tax Flexibility

LLCs offer flexibility in taxation, allowing members to choose between being taxed as a sole proprietorship, partnership, S corporation, or C corporation. This flexibility enables business owners to select the taxation method that best aligns with their financial objectives and long-term strategies.

Operational Autonomy

Forming an LLC provides operational autonomy, allowing business owners to make decisions independently without the extensive formalities associated with corporations. This flexibility can be advantageous in the dynamic and rapidly evolving landscape of e-commerce and dropshipping.

| Consideration | LLC for Dropshipping | Sole Proprietorship | Partnership | S Corporation |

|---|---|---|---|---|

| Liability Protection | Personal assets are protected from business liabilities | No distinction between personal and business liabilities | Shared liability among partners | Personal assets are protected from business liabilities |

| Taxation | Flexible options for taxation, including pass-through taxation | Business income is reported on the owner’s personal tax return | Profits and losses are passed through to partners | Pass-through taxation, different ownership structure |

| Management Structure | More flexibility in management and decision-making | Owner has full control and decision-making authority | Shared management responsibilities among partners | Different ownership structure, potential tax advantages |

| Compliance Obligations | Subject to ongoing compliance requirements, such as annual filings and business licenses | Fewer formalities and compliance requirements | Subject to partnership compliance obligations | Subject to S corporation compliance requirements |

Legal and Tax Implications of Starting a Dropshipping Business

When launching a dropshipping business, it’s crucial to understand the legal and tax implications to ensure compliance with the relevant regulations and obligations. The intersection of e-commerce, international trade, and tax laws can be complex, necessitating a comprehensive understanding of the legal landscape.

Tax Considerations

Dropshipping businesses are subject to various tax obligations, including sales tax, income tax, and international tax regulations if engaging in cross-border trade. Navigating these tax considerations requires meticulous record-keeping, understanding of nexus laws, and compliance with state and federal tax requirements.

Legal Obligations

From a legal standpoint, dropshipping businesses must adhere to consumer protection laws, product safety regulations, and e-commerce compliance standards. Additionally, understanding intellectual property rights, such as trademarks and copyrights, is crucial to avoid potential legal disputes.

Step-by-Step Guide to Setting Up an LLC for Your Dropshipping Business

Forming an LLC for a dropshipping business involves several steps, from selecting a suitable business name to filing the necessary documentation with the appropriate state authorities. While the specific requirements may vary by jurisdiction, the general process typically includes the following steps:

Step 1: Choose a Name and Conduct a Name Search

Selecting a unique and appropriate business name is the first step in establishing an LLC. Conduct a thorough name search to ensure the chosen name is available and compliant with state naming guidelines.

Step 2: Appoint a Registered Agent

An LLC must designate a registered agent who is responsible for receiving legal documents and official correspondence on behalf of the business. The registered agent must have a physical address within the state of formation.

Step 3: File Articles of Organization

File the Articles of Organization with the Secretary of State or the relevant state agency. This document officially registers the LLC with the state and outlines essential details, such as the business’s purpose, management structure, and member information.

Step 4: Create an Operating Agreement

While not always a mandatory requirement, drafting an operating agreement is highly recommended for LLCs. This document outlines the ownership and operational structure of the business, including the rights and responsibilities of members.

Step 5: Obtain an EIN and Comply with Tax Obligations

Obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) for tax purposes. Additionally, ensure compliance with state and federal tax obligations, including sales tax registration if applicable.

Step 6: Fulfill Ongoing Compliance Requirements

LLCs are subject to ongoing compliance obligations, such as annual filings, business licenses, and state-specific requirements. Fulfilling these obligations is essential to maintain the good standing and legal validity of the LLC.

Common Misconceptions About LLCs and Dropshipping

Amidst the discussions surrounding LLCs and dropshipping, several misconceptions and myths persist. It’s important to address these misconceptions to provide clarity and dispel any misunderstandings that may influence entrepreneurs’ decisions.

Misconception 1: An LLC Guarantees Instant Success

While forming an LLC can offer numerous benefits, it does not guarantee automatic success for a dropshipping business. Success is contingent on various factors, including market research, product selection, marketing strategies, and customer satisfaction.

Misconception 2: An LLC Eliminates the Need for Business Insurance

While an LLC provides limited liability protection, it does not negate the necessity of business insurance. Obtaining appropriate insurance coverage is essential to safeguard the business against unforeseen circumstances, liability claims, and other risks.

Misconception 3: Forming an LLC is Excessively Complex

Contrary to common belief, the process of forming an LLC is relatively straightforward, especially with the availability of online resources and professional services. With proper guidance, entrepreneurs can navigate the LLC formation process efficiently.

Alternatives to an LLC for Dropshipping Entrepreneurs

While an LLC is a popular choice for many dropshipping entrepreneurs, alternative business structures may also be viable depending on individual circumstances and preferences. It’s essential to explore these alternatives to determine the most suitable option for a dropshipping venture.

Sole Proprietorship

Operating as a sole proprietorship is the simplest and most common form of business structure. In this model, the business and the owner are considered a single entity, and the owner is personally liable for the business’s debts and obligations.

Partnership

For those entering into a dropshipping venture with one or more partners, forming a partnership may be a viable option. Partnerships offer shared ownership and management responsibilities, with profits and losses distributed among the partners.

S Corporation

Some dropshipping entrepreneurs may opt for an S corporation (S corp) status, which provides pass-through taxation similar to an LLC while allowing for a different ownership structure and certain tax advantages.

Expert Tips for Navigating Legalities in Dropshipping

Navigating the legalities of dropshipping, including the decision to form an LLC, can be complex. Here are some expert tips to help entrepreneurs effectively manage the legal aspects of their dropshipping business:

Conduct Thorough Research and Due Diligence

Before making any legal decisions, it’s essential to conduct comprehensive research and due diligence. Understand the legal requirements, tax implications, and compliance obligations specific to dropshipping and e-commerce.

Seek Professional Guidance

Consider consulting with legal and financial professionals who specialize in small business and e-commerce law. Their expertise can provide invaluable insights and guidance tailored to the unique needs of a dropshipping business.

Prioritize Compliance and Risk Management

Maintaining compliance with relevant laws and regulations is essential for the long-term success and sustainability of a dropshipping business. Implement robust risk management practices and prioritize legal compliance in all business operations.

Regularly Review and Update Legal Structures

As the dropshipping business evolves, it’s important to periodically review and update the legal structures, taking into account changes in the business landscape, regulatory environment, and operational requirements.

Conclusion

In conclusion, the decision to form an LLC for a dropshipping business is influenced by various factors, including liability protection, tax flexibility, and long-term business objectives. While an LLC offers compelling advantages, entrepreneurs should carefully evaluate their unique circumstances and consider alternative business structures before making a decision. Navigating the legalities of dropshipping necessitates a thorough understanding of the legal and tax implications, as well as proactive compliance with relevant regulations. By leveraging expert guidance, conducting due diligence, and prioritizing legal compliance, entrepreneurs can establish a solid legal foundation for their dropshipping ventures, paving the way for sustained success in the dynamic e-commerce landscape.